It would be great if, after establishing insurance terms, you could always count on accurate compensation. Unfortunately, receiving a final payment can turn into a complicated situation. Below we pointed out a few tips on how to rectify your rejected insurance claim.

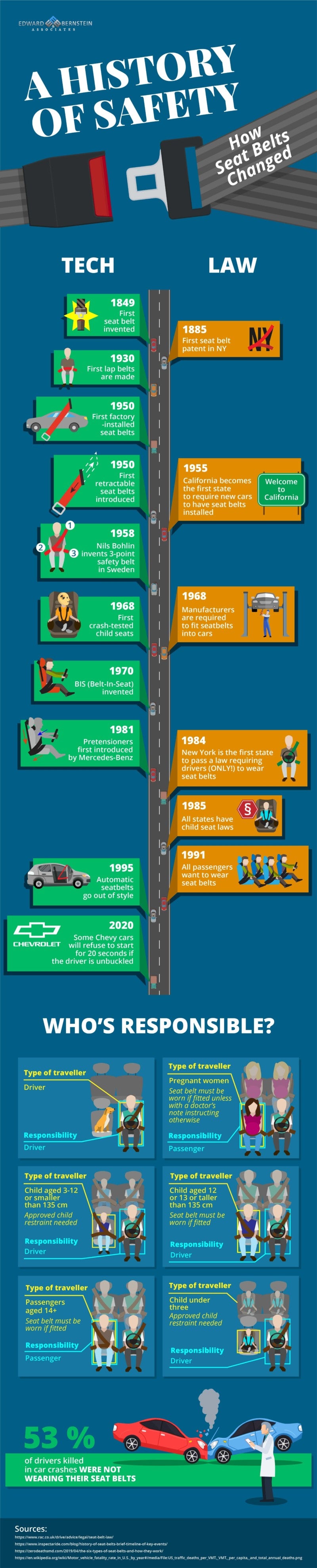

Look for legal advice. If you find it hard to understand complex contracts and procedures of the insurance claim, contact a professional like Las Vegas Injury Lawyer. Your case may need some additional research and focus on the details you may typically not pay attention to. It’s also essential during the car accident if you obeyed the seat belts’ rules and determine who is responsible for any eventual oversights.

If you were responsible for the cause of the accident it is possible you would need to apply for sr22 insurance cover to help with proceedings. This would certainly be applicable if you had accrued various traffic violations over time and were caught driving recklessly.

Contact your insurance company. It can happen in many businesses that they reject your insurance claim due to bad faith. If you feel that your case has been rejected unfairly, definitely contact your insurance provider and complain about your status, ask many questions and persuade them of your situation and specific demands. Stick to the facts, prepare all the necessary information, and fight for your compensation. Every insurance company is required by law. Please get familiar with the process and show them you prepared yourself well.

Appeal! Don’t you give up after facing rejection of your insurance claim. In most cases, you will have up to 180 days to appeal from your rejection date. The appeal review takes from 30 to 60 days. If it’s urgent, you can qualify for the final report, which takes around three days. The durability depends on the circumstances.

Summing up, if you feel like your form has been rejected for no reason, always double-check if you didn’t make any errors or given wrong information in your form. Talk to your insurance company and ask for legal advice professionals. There is a high chance you will receive the payment you deserve after being injured.