From the dizzying heights of graduation to the steep drops of home buying, financial security feels as elusive as that ever-sneaky golden ring. The answer lies in planning and strategic decision-making.

We’ve compiled six key tools and tips to help you secure the ride for you and your family. Each life stage brings unique challenges and opportunities for smart money management.

We’ll guide you through student loans, fashion budgeting, business banking, smartphone investments, and more, turning those often-overwhelming money matters into manageable steps toward financial stability. So, buckle up, keep your hands inside the vehicle, and let’s begin the journey to financial security together!

1. Let MPOWER Help You With Pesky Student Loans

Ah, the sweet scent of newly printed diplomas and the less sweet burden of student loans. In the real world, we’ve swapped textbooks for tax forms and study groups for salary negotiations. Like an uninvited guest at the end of the party, one thing that lingers is those student loans. They’re stubborn, but with some smart strategies, they’re not unbeatable.

If your student loans have become your constant ‘plus one’, it’s time to kick them to the curb. With MPOWER by your side, managing these loans becomes easier, whether getting a student loan without cosigner support or through other methods. Think of MPOWER as your financial fairy godparent, helping you navigate the often-confusing maze of student loan repayment.

With broad-ranging resources, MPOWER can help you devise an effective game plan to tackle your loans, leading to more financial freedom and a little less stress. It’s high time to say adieu to your “loanly” nights and embrace the smarty pants you truly are!

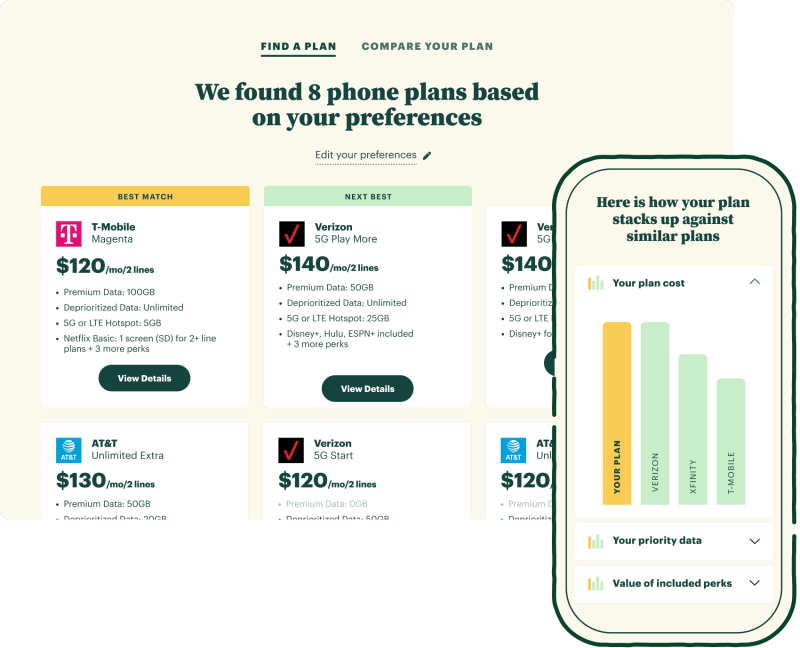

2. Snag the Best Smartphone Deals With Navi

Remember when a phone was just a device to call people? How the times have changed! Now, they’re our lifelines and trusty sidekicks. Just like a good sidekick, a smartphone should be reliable, high-performing, and, importantly, won’t make you empty your savings.

That’s where Navi comes in, your ever-reliable partner in your search for the best phone deals on the market. Navi helps ensure you get the most bang for your buck in the smartphone market through a broad network and extensive industry knowledge. It’s like having a personal shopper for your tech needs, carefully selecting the best deals that match your requirements and budget.

Navi covers the latest smartphone technology while linking you with deals that make sense for your budget and lifestyle. They make the process simple and keep everything in one place, so you’re not jumping around between providers and brick-and-mortar stores. Just think about the time and cash you can save with a simple, streamlined phone shopping process.

We believe your phone should work for you, not the other way around. So, instead of digging deep into your pockets to afford the latest smartphone, why not let Navi dial you into some serious savings? After all, even superheroes love a good deal!

3. Shield Your Kingdom With Landlord Insurance From Steadily

If you’re a landlord, you’re not just the property owner; you’re the ruler of your kingdom. And every good ruler knows the importance of defending their territory. But instead of drawbridges and moats, the modern landlord needs a sturdy shield of landlord insurance.

Think of Steadily as your loyal knight, protecting your real estate realm while reducing your landlord insurance cost. With their comprehensive offerings, Steadily helps protect your kingdom from all sorts of unforeseen circumstances. Because while you can’t predict the future, you can definitely prepare for it.

Landlord insurance provides crucial protection in various situations. For instance, it can assist when tenants damage your property, covering repair costs. It also safeguards against financial losses resulting from tenant defaults or rental income disruptions due to natural disasters like fire or storms. Additionally, landlord insurance can offer liability coverage, helping with legal expenses if someone gets injured on your rental property.

So, why not let Steadily don their armor and defend your rental property? After all, every kingdom needs its shield, and every landlord needs extra help. So, suit up, your majesty, and let’s protect your real estate realm together!

4. Invest in a Gold IRA With American Hartford Gold

Picture this: You’ve finally retired after decades of hard work. You’re ready to kick back, relax, and enjoy life, only to realize that your financial future is as shaky as a Jenga tower five moves away from toppling. Cue the dramatic music, right? Wrong. With a Gold IRA and American Hartford Gold in your corner, retirement can be less horror story and more fairytale.

A Gold IRA isn’t just for the Scrooge McDucks of the world. It’s an opportunity for you to invest in a more stable future. With American Hartford Gold, you can dive into the world of gold investment without feeling like you’re going off the deep end. They provide a broad and comprehensive approach to gold IRA investments, making them accessible and understandable for everyone.

Investors who seek to diversify their retirement portfolios and safeguard their wealth against economic uncertainty may benefit from a Gold IRA. This type of individual retirement account allows individuals to hold physical gold and other precious metals as assets, providing a hedge against inflation and potential currency devaluation.

So, if you’re dreaming of golden sunsets during your golden years, let American Hartford Gold be your guiding star. Let’s turn your retirement from a wobbly Jenga tower into a steady pyramid of gold, one smart investment at a time!

5. Invest With the Acorns Investment App for Your Smartphone

Life’s too short to be chained to a desk, poring over financial reports and stock forecasts. Why not take your investments on the road with you, wherever your heart desires? With Acorns, you can do just that.

Thanks to the Acorns investment account for smartphones, you can manage your investments as easily as sending a text message. They make the often-daunting world of investments as user-friendly as your favorite app. Plus, with their comprehensive service offering, you’re not just investing on the go; you’re investing with confidence.

A smartphone app can be highly beneficial for beginner investors due to its user-friendly interface, accessibility, and educational resources. Such apps often provide simplified investment options, allowing users to start with small amounts of money.

Acorns offers real-time market data, news updates, and investment analysis, helping beginners make informed decisions. Additionally, many apps offer educational content, tutorials, and investment tips, empowering beginners to learn and grow their investment knowledge conveniently on their smartphones.

So, next time you find yourself daydreaming of financial freedom during your morning commute or mid-hike, know that your dreams are just a swipe away!

6. Make Cents With a Physical Crypto Wallet From Ledger

Cryptocurrency is like the cool new kid on the financial block. Still, crypto can feel as puzzling as a Rubik’s cube (and almost as retro). Ledger is here to put the cool back in crypto and the ‘fun’ in your financial planning with their physical crypto wallet.

Having a physical crypto wallet from Ledger is like having your very own financial Swiss army knife. It provides a robust and comprehensive approach to tangibly managing your digital assets. Plus, Ledger has ensured this isn’t a puzzle you must solve alone.

While crypto can seem complex, Ledger makes it easier to understand from a security standpoint. A physical crypto wallet enhances security by storing cryptocurrency offline, away from potential online threats. It provides an added layer of protection against hacking and malware attacks, ensuring private keys are kept offline and reducing the risk of unauthorized access to funds.

So, why not join the crypto cool kids with a hardware wallet from Ledger? After all, making ‘cents’ of your financial future has never been more in your hands!

Financial Security for You and Your Family

Well, dear reader, we’ve navigated the twists and turns of this financial rollercoaster together, from student loan strategies to the realm of physical crypto wallets. Each stage of life, and each part of this journey, comes with unique financial challenges and opportunities.

With the right tools and strategies at your side, these challenges become less daunting and the opportunities more exciting.

Securing your family’s financial future is less about the ‘perfect’ decision and more about informed strategic ones. Understand your options and make the decisions that best suit you and your loved ones at each stage of life.