You shop online, you watch TV online, you invest online. You even do your taxes online. In 2016, you can do pretty much anything over the Internet – and you do – so why would you log off as soon as you need to borrow money? It doesn’t make sense to meet with a lender in person when you could apply online at your convenience. Forget about brick-and-mortar lenders that require lengthy interviews at odds with your busy schedule. With the exception of mortgages, most loans – especially lines of credit – don’t need these kinds of meetings. Instead of waiting for an interview, get your line of credit from a direct online lender.

In an increasingly digital world, direct online lenders are a convenient alternative to traditional lenders. If you work two or more jobs, you can appreciate how difficult it is to find time during a business day to do anything, let alone drive out to a lender and explain why you need a line of credit. Online lenders understand that many of their clients follow busy schedules, so they require no in-person meeting before they facilitate your line of credit. That means you don’t have to waste valuable time off work in order to travel to their location for an appointment.

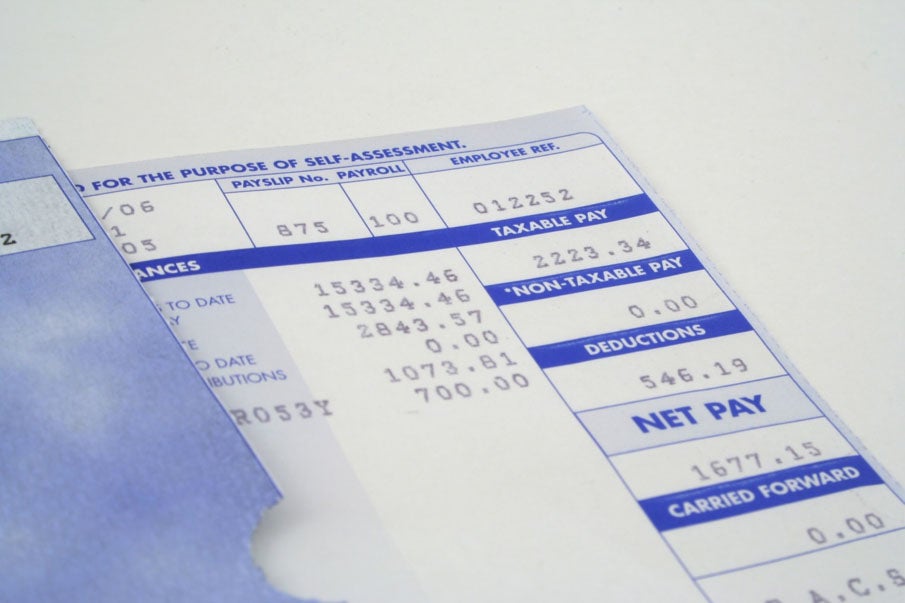

Instead, most (if not all) of their business is conducted online. You apply for your line of credit through their website when you have the time. This can be at 2 o’clock in the afternoon or 2 o’clock in the morning or any other time you have access to the Internet. As long as you have a valid bank account, email address, and source of income, you can fill out their simple, one-page application form. Before you receive approval, you will receive a phone call from one of the credit representatives in order to confirm the details of your application.Generally, these calls can be scheduled to fit a time in your day that you can answer your phone.

If you’re approved, you can receive $1,000 for your personal line of credit. This limit will differ from lender to lender and state to state, so do your homework to see how much you could receive depending on your location. However,if you receive your line of credit, once you start using it, direct online lenders make it possible to make your minimum payments online, so you don’t have to rely on the USPS to deliver a check and hope it arrives on time.

Since you will be relaying a lot of your personal information including confidential bank account numbers over the Internet, it’s important to search out a direct online lender like MoneyKeythat provides enough online precautions to keep your data safe. If you apply for a line of credit from MoneyKey, your personal information is secured by Verified Site Certificates, sophisticated firewalls, and Secure Socket Layer (SSL) encryption – all of which is monitored closely by a representative.

With these safety features in place, you don’t have to worry about securing a personal line of credit online. It’s a safe, secure, and entirely convenient way of getting a line of credit. Embrace the 21st century and look for a line of credit through a direct online lender.